Business

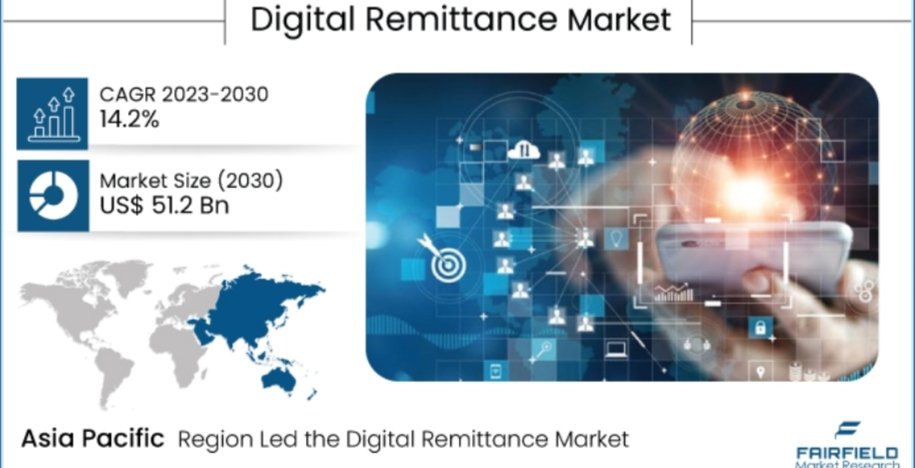

Digital Remittance Market to Hit $51.2 Billion by 2030

According to Fairfield Market Research, the Digital Remittance Market is poised for substantial growth, with market size expected to reach US$51.2 billion by 2030, up from US$20.2 billion in 2023, reflecting a robust CAGR of 14.2% during the forecast period. This growth is driven by several key factors, including increased international migration, globalization, and the growing need for efficient cross-border transactions.

Visit our Research Report: https://www.fairfieldmarketresearch.com/report/digital-remittance-market

Key Growth Determinants

- Urbanization and Cross-Border Transactions The global population is experiencing rapid urbanization and industrialization, driving the development of rural and semi-rural areas worldwide. As urban populations swell, cross-border transactions have become increasingly common. The World Bank reports that the current urban population stands at 56% of the world’s total, with projections indicating that this figure will more than double by 2050. This migration trend is driving up the volume of cross-border transactions, traditionally conducted by large corporations and governments, but now facilitated by digital platforms for small-scale transactions as well.

- Rocketing Smartphone Sales Digital remittance is gaining momentum due to the rapid pace of digitalization and the widespread adoption of smartphones. According to the GSMA’s 2023 State of Mobile Internet Connectivity Report, over half of the global population, approximately 4.3 billion individuals, now owns smartphones. This widespread smartphone adoption is fueling the demand for digital remittance platforms, offering convenient and efficient means of transferring money globally.

- Surge in International Transactions International money transfers, facilitated by digital remittance services, are more efficient than traditional methods. The World Bank projected a 4.2% increase in officially registered money transfers to low- and middle-income countries (LMICs) in 2022, reaching $630 billion. This increase highlights the growing importance of digital remittance in facilitating international transactions.

Major Growth Barriers

- Cybersecurity Risks Cybersecurity risks pose a significant challenge to the growth of the digital remittance market. Cyber attacks, data theft, and fraudulent activities can lead to financial losses and damage the reputation of service providers. The World Economic Forum’s 2020 Global Risk Report highlighted the low detection rate of cybercrimes in the U.S., and Cybersecurity Ventures predicts that global cybercrime will cost companies $10.5 trillion annually by 2025. To mitigate these risks, digital remittance companies must invest in robust cybersecurity measures, increasing operational costs and potentially reducing profit margins.

- Regulatory Challenges and Compliance Requirements Governments and regulatory bodies enforce strict rules to combat money laundering and other illicit activities, presenting a complex and costly challenge for remittance service providers. Compliance with these regulations requires robust measures, thorough customer due diligence, and extensive reporting systems. Navigating these compliance challenges can impede the growth and expansion of digital remittance services.

Key Trends and Opportunities to Look at

- Blockchain and Cryptocurrency Integration The integration of blockchain technology and cryptocurrencies into the digital remittance market is creating exciting opportunities for growth. Blockchain’s decentralized ledger system provides heightened security, transparency, and traceability, fostering trust among users. Cryptocurrencies, particularly stablecoins, offer swift and cost-effective international transfers, bypassing traditional intermediaries like banks. As these technologies mature, digital remittance companies that embrace them can attract tech-savvy customers and create new revenue streams.

- Efforts to Enhance Security During Digital Money Transfers Startups and e-banking systems are investing in advanced encryption standards and security models to streamline international remittance processes, reducing time and cost while enhancing user-friendliness. Companies like TransferWise and Wave prioritize encrypting financial messages to safeguard user data. Additionally, e-banking systems are utilizing biometric scans and image verification to offer more secure authentication mechanisms, enhancing the security of digital remittance services.

- Untapped Potential in Developing Markets Developing countries with substantial populations lacking access to traditional banking services present a significant opportunity for digital remittance solutions. The widespread availability of affordable smartphones and increasing internet connectivity offers a pathway to reach these underserved populations. By delivering convenient and cost-effective remittance services, companies can access a vast customer base, foster increased financial inclusion, and stimulate growth within the digital remittance market.

Regional Insights

- Asia Pacific’s Dominance The Asia Pacific region is anticipated to account for the largest share of the global digital remittance market, driven by increasing income levels, enhanced financial infrastructure, and greater penetration of smartphones. Key countries such as India, China, and the Philippines are major recipients of remittances, contributing to the region’s dominance.

- North America’s Growth Potential North America benefits from a robust financial infrastructure, widespread internet and smartphone usage, and a substantial migrant population. These factors contribute to the region’s expanding digital remittance market. As of 2023, smartphone ownership in the United States stood at 81.6%, highlighting the region’s potential for growth.

Competitive Analysis

The global digital remittance market is consolidated, with key players including Western Union, MoneyGram International, TransferWise, Remitly, WorldRemit, Ria Financial Services, PayPal/Xoom, OFX, Skrill, and Revolut. These companies are prioritizing enhancements to user interfaces, integrating cutting-edge security protocols, and embracing innovations such as blockchain technology to facilitate quicker and more secure transactions.

About Us

Fairfield Market Research is a UK-based market research provider. Fairfield offers a wide spectrum of services, ranging from customized reports to consulting solutions. With a strong European footprint, Fairfield operates globally and helps businesses navigate through business cycles, with quick responses and multi-pronged approaches. The company values an eye for insightful take on global matters, ably backed by a team of exceptionally experienced researchers. With a strong repository of syndicated market research reports that are continuously published & updated to ensure the ever-changing needs of customers are met with absolute promptness.

-

Tech1 year ago

Tech1 year agoHow to Use a Temporary Number for WhatsApp

-

Business2 years ago

Business2 years agoSepatuindonesia.com | Best Online Store in Indonesia

-

Social Media2 years ago

Social Media2 years agoThe Best Methods to Download TikTok Videos Using SnapTik

-

Technology2 years ago

Technology2 years agoTop High Paying Affiliate Programs

-

Tech1 year ago

Tech1 year agoUnderstanding thejavasea.me Leaks Aio-TLP: A Comprehensive Guide

-

FOOD1 year ago

FOOD1 year agoHow to Identify Pure Desi Ghee? Ultimate Guidelines for Purchasing Authentic Ghee Online

-

Instagram3 years ago

Instagram3 years agoFree Instagram Auto Follower Without Login

-

Instagram3 years ago

Instagram3 years agoFree Instagram Follower Without Login