Technology

Transforming Financial Management in India: The Role of Account Aggregators

The digital revolution is fast overtaking even the way we handle our finances.Among the most important developments in this space is the account aggregator framework—an initiative of the Reserve Bank of India. This is sure to totally change the face of financial data sharing and ease the procedure for access and management of financial information. In this blog, we will be talking about the aa account RBI framework, its benefits, and how it impacts the financial landscape in India; also, how it will work toward some of the challenges lying ahead.

Understanding the Account Aggregator Framework

The AA is the regulated entity that facilitates the secure sharing of financial data amongst various financial institutions and customers. It also enables one to consolidate all the financial information in one place, including information on bank accounts, insurance policies, mutual funds, pension funds, and the like. This could be accessed through an account aggregator app in India that provides a unified view of the financials of an individual or business house.

Unlike legacy methods, where financial data is dispersed through multiple platforms, the AA framework simplifies financial management by data centralization. The AA framework is premised on a consent-based sharing of data and ensures that customers remain in control of their financial information.

Key Stakeholders in the AA Ecosystem

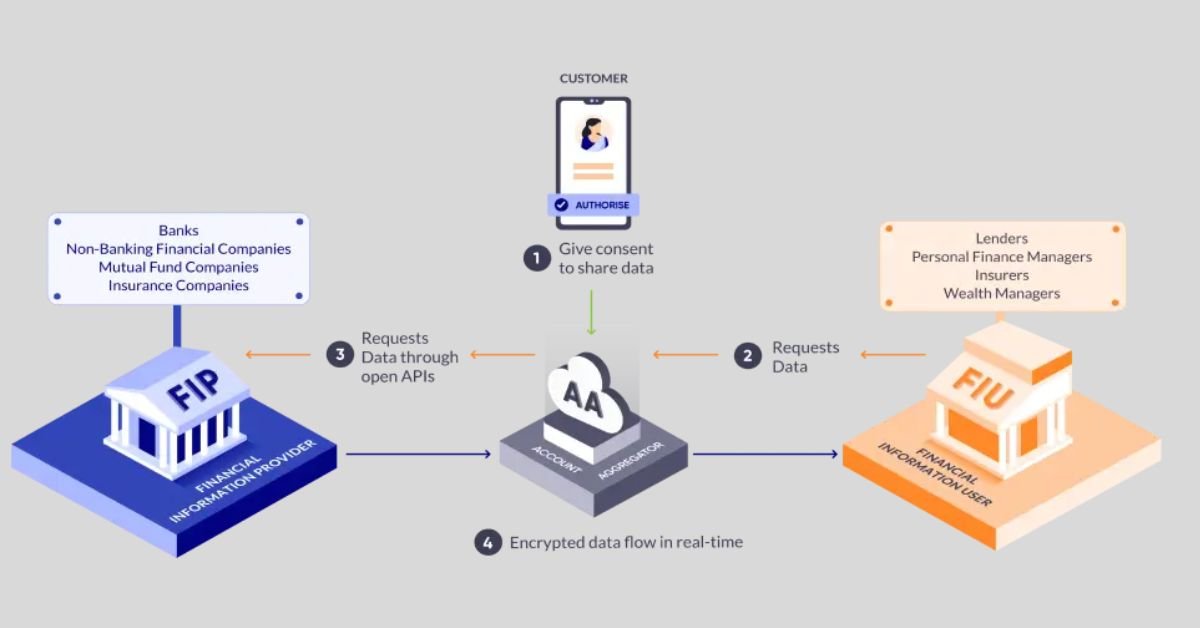

The AA framework’s overall success is based on the cooperation of various principal actors:

a. Financial Information Providers(FIP): Organizations such as banks, insurance companies, and mutual fund houses possess financial information, which the FIPs supply to the AAs with the explicit consent of the customer.

b. Financial Information Users (FIUs): These are lending institutions, financial planners, and credit assessment agencies that utilise data in the form provided by FIPs. They depend on it for offering services regarding loans, investment advice, or risk assessments.

c. Account Aggregators: Account Aggregators within this architecture act as intermediaries between FIPs and FIUs. They are to ensure responsible and safe data transfer while maintaining privacy and data integrity within the ecosystem. The AAs will manage user consent and share information only among the relevant parties.

Advantages of the AA Framework

-

More Financial Inclusion

The aa account RBI framework is very instrumental in enhancing financial inclusion, most notably with respect to underserved populations—small businesses, thin-file households, and individuals. For example, an AA may permit a small business operator to consolidate transaction histories from often multiple bank accounts and then share the consolidated information with potential lenders in support of a loan application.

-

Improved Credit Assessments

One of the most compelling value-adds on the AA framework is the way it helps in enhancing the accuracy of credit assessment. By providing consolidated views on the financial health of a borrower, AAs offer the opportunity to make informed borrowing decisions to the lenders. The outputs in doing so will be fewer default cases and more appropriate credit offers, hence a more sustained lending environment.

-

Streamlined Financial Management

It could be too much work managing finances across so many accounts and platforms. The AA framework alleviates this stress because it is under a single platform where all financial data can be aggregated. The management integrates the system in a manner that is efficient in deriving good financial decisions.

-

Reduced Time and Cost in Lending

As data sharing is automated, AAs convert manual collection and verification of documents into quicker loan disbursals. This reduces the time and the cost. Efficiency allows lenders to serve a larger market and more customers in less time.

-

More Innovation and More Competition

The AA framework unleashes this potential by giving, for the first time, access to the financial data residing in controls with the established financial institutions, to fintech companies and all privately financed new entrants. This leads to these companies developing innovative financial products and services, thereby increasing competition and better service for the consumer.

Global Context and India’s Unique Approach

The AA framework of India is not only the first of its kind but also absolutely unique in its approach to similar other initiatives around the world. Take, for instance, the case of Singapore’s Financial Data Exchange: it is an analogous model at one level but very much different from the open and interoperable infrastructure-based one by India, encouraging great private sector participation.

Of the many nations that have adopted open banking frameworks, India’s AA framework stands out because it covers an inclusively broader spectrum of financial data, which not many countries have furnished at this juncture, including insurance and pension accounts with banking data. This gives an overall perspective to the user regarding their financial situation and happens, therefore, to be rather potent, leading to keeping one’s financing in order.

Challenges Ahead

Despite all the potential benefits, a number of challenges ought to be addressed if the AA framework is to meet with success.

a. Information Privacy and Security

The success of the AA framework will largely depend on consumer data protection. This will press service providers to come up with the necessary robust security measures in place to safeguard data channels from leaking out or allowing unauthorized access: encrypted data channels and strong authentication protocols in place. It is very important for gaining wide adoption as trust by users in the AA system.

b. Financial Literacy

Many customers will not know how to benefit fully from the AA framework, nor know how to properly use the system safely. There will be a further need for financial literacy as the users of the AA systems are to be enlightened upon their rights and how best to manage their information. This would foster trust and have more people using the system.

c. Interoperability

Working with the AA framework will not be possible without some kind of agreement by financial institutions and service providers on common data formats and protocols. This would require standardization and continual collaboration among different players to ensure excellent interoperability between the financial ecosystem body.

In conclusion

As India continues to innovate in the financial sector, the AA framework developed by RBI is set to lay the cornerstone of financial management. Putting the power back in the hands of users with control and consent over financial data and significantly effortless sharing of data, the AA framework is changing the paradigm of engagement with financial institutions.

A promising development within this framework is Anumati, a platform powered by Perfios Account Aggregation Services Pvt Ltd. This is one of the first initiatives to resculpt the contours for a future of account aggregation in India.

New and unbeatable standards within the industry are set by Anumati account aggregator app india with superior commitment toward privacy and seamless sharing of data. It does this so that a user can take his or her financial roads through with unbound confidence and ease.

-

Tech1 year ago

Tech1 year agoHow to Use a Temporary Number for WhatsApp

-

Business2 years ago

Business2 years agoSepatuindonesia.com | Best Online Store in Indonesia

-

Social Media2 years ago

Social Media2 years agoThe Best Methods to Download TikTok Videos Using SnapTik

-

Technology2 years ago

Technology2 years agoTop High Paying Affiliate Programs

-

Tech12 months ago

Tech12 months agoUnderstanding thejavasea.me Leaks Aio-TLP: A Comprehensive Guide

-

FOOD1 year ago

FOOD1 year agoHow to Identify Pure Desi Ghee? Ultimate Guidelines for Purchasing Authentic Ghee Online

-

Instagram3 years ago

Instagram3 years agoFree Instagram Auto Follower Without Login

-

Instagram3 years ago

Instagram3 years agoFree Instagram Follower Without Login