Business

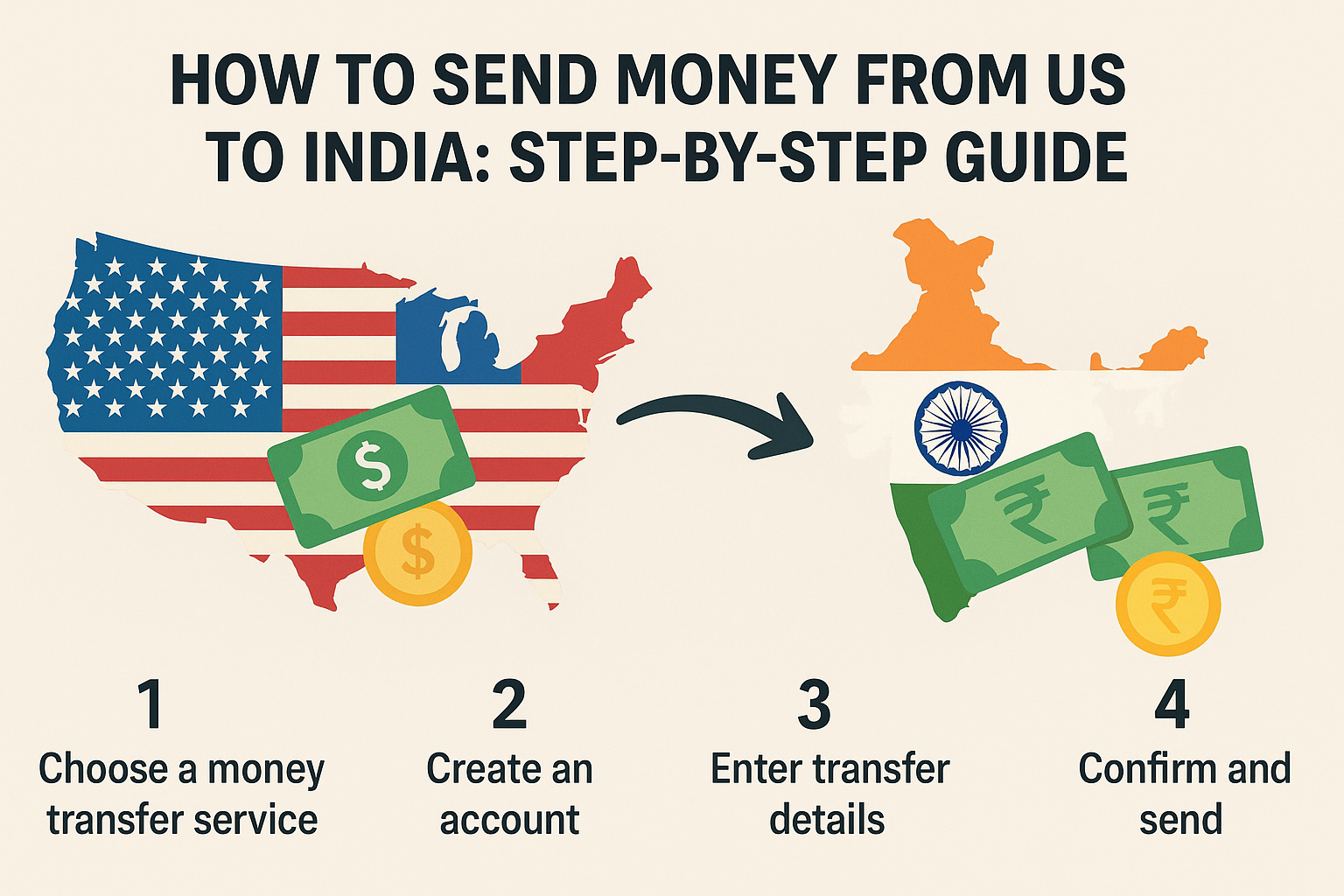

How to Send Money from US to India: Step-by-Step Guide

US banking regulations and Indian compliance requirements create complexity when you need to send money from us to india efficiently. Multiple regulatory frameworks, documentation requirements, and transfer method options make it challenging to choose the most cost-effective and secure approach.

Understanding remittance transfer regulations specific to US-India corridors helps you navigate compliance requirements while accessing competitive exchange rates and reliable delivery timelines for your financial obligations.

What’s the Best Way to Send Money from US to India?

Bank wire transfers through established US banks offer maximum security and regulatory compliance, with Federal Deposit Insurance Corporation (FDIC) protection and comprehensive tracking throughout the transfer process.

Online money transfer platforms like Wise, Remitly, and Xoom provide competitive exchange rates with lower fees compared to traditional banks, whilst maintaining full regulatory compliance under US Money Services Business (MSB) licensing.

Remittance transfer services through specialized providers offer promotional rates for new customers and volume discounts for regular transfers, making them cost-effective for consistent sending patterns.

How Do Remittance Transfer Regulations Affect Your Options?

Consumer Financial Protection Bureau (CFPB) regulations mandate disclosure of exchange rates, fees, and delivery timelines before you commit to transfers, ensuring transparency in remittance transfer pricing and terms.

Anti-Money Laundering (AML) requirements necessitate identity verification, source of funds documentation, and transaction monitoring for transfers exceeding specific thresholds, typically $3,000 for enhanced due diligence.

Send money from us to india transactions must comply with both US export regulations and Indian import regulations, requiring proper purpose codes and documentation for amounts exceeding $5,000 annually.

What Documentation Do You Need for US-India Transfers?

Identity verification requires valid US identification (driver’s license, state ID, or passport) plus Social Security Number or Individual Taxpayer Identification Number for all remittance transfer services.

Source of funds documentation becomes necessary for large transfers, including pay stubs, bank statements, or business income verification to satisfy AML compliance requirements under US regulations.

Recipient verification in India requires complete beneficiary bank details including SWIFT codes, account numbers, and Indian addresses for successful send money from us to india transactions.

Which Transfer Method Offers the Lowest Costs?

Online platforms typically offer exchange rate margins 1-2% closer to mid-market rates compared to traditional banks, with fixed transfer fees ranging from $3-15 regardless of transfer amount.

Bank wire transfers charge $15-50 per transaction plus exchange rate margins of 2-4%, making them expensive for smaller amounts but competitive for transfers exceeding $10,000.

Remittance transfer cost comparison should include total transfer costs (fees plus exchange rate margins) rather than just quoted fees, as exchange rate differences significantly impact the amount received in India.

Key Takeaways

To send money from us to india efficiently, choose between bank wires for maximum security, online platforms for competitive rates, or specialized remittance services for volume discounts. Remittance transfer regulations require identity verification, AML compliance, and proper documentation for transparency and security. Online platforms typically offer better exchange rates with lower fees compared to traditional banks. Compare total transfer costs including exchange rate margins, and ensure recipient bank details are complete for successful transfers.

-

Tech1 year ago

Tech1 year agoHow to Use a Temporary Number for WhatsApp

-

Business2 years ago

Business2 years agoSepatuindonesia.com | Best Online Store in Indonesia

-

Social Media2 years ago

Social Media2 years agoThe Best Methods to Download TikTok Videos Using SnapTik

-

Technology2 years ago

Technology2 years agoTop High Paying Affiliate Programs

-

Tech12 months ago

Tech12 months agoUnderstanding thejavasea.me Leaks Aio-TLP: A Comprehensive Guide

-

FOOD1 year ago

FOOD1 year agoHow to Identify Pure Desi Ghee? Ultimate Guidelines for Purchasing Authentic Ghee Online

-

Instagram3 years ago

Instagram3 years agoFree Instagram Auto Follower Without Login

-

Instagram3 years ago

Instagram3 years agoFree Instagram Follower Without Login